Copyright 2024 Strategic Funding Source, Inc. All rights reserved. Kapitus and the Kapitus logo are registered trademarks of Strategic Funding Source, Inc. Loans made or brokered in California are made or brokered pursuant to California Finance Lenders License No. 603-G807.

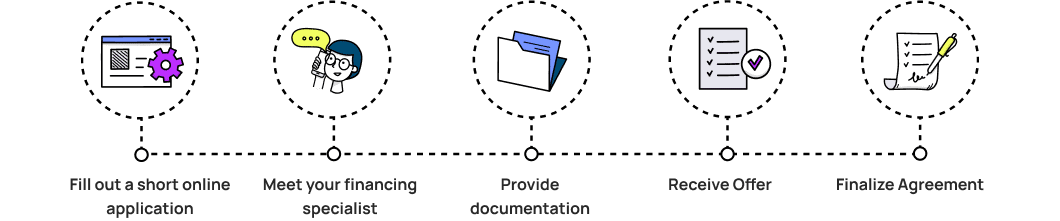

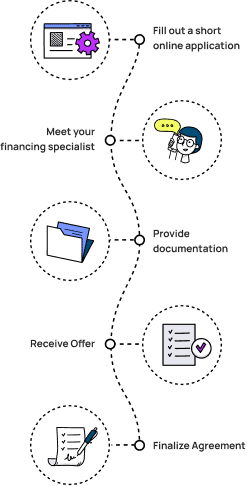

What to Expect

SBA Loans at a Glance

Loan Amounts

Up to $5,000,000

Repayment Terms

Varies

Payment Options

Monthly

Available Through

Kapitus Financing Network

SBA Loans 101

What are SBA Loans?

An SBA business loan is a flexible financing solution for your business.

It is financing supported by the U.S. Small Business Administration, which allows lenders to provide loans to borrowers with more favorable terms and more flexible underwriting criteria than conventional loans.

Because the U.S. Government backs these loans, they can offer your small business greater accessibility, lower down payments, and longer repayment terms than other financing options.

How do SBA Loans Work?

SBA Loans work by providing small businesses with loans guaranteed by the U.S. Small Business Administration. Your SBA loan is facilitated through partnering lenders, such as banks, credit unions, or other financial institutions.

Once a business owner is approved for an SBA loan, funds will be distributed, and the borrower will repay the loan according to the terms set in the agreement.

What sets SBA Loans apart from other financing options is that they require less risk for the lender. In the event that a borrower defaults on their loan payments, the SBA Guarantee steps in to cover a portion of the outstanding balance. This assurance encourages lenders to provide borrowers with more attractive terms and lower interest rates, as well as potentially provide financing to businesses that might not otherwise qualify for conventional loans.

Benefits of Getting an SBA Loan Through Kapitus

Streamlined Process

Kapitus financing specialists are committed to making your loan process as seamless and pain-free as possible. After you’ve submitted your application, our specialists will carefully review it to ensure you meet all initial requirements. Once it is time to move forward, they will guide you in collecting all necessary documentation needed to complete your application package.

Improved Cashflow, More Growth

Capped interest rates, terms up to 25 years and loan amounts up to $5 Million allow for a large influx of working capital with monthly payments – giving you the freedom to do more with the funds you borrow. Added to that, there are very few limitations on use, meaning that you can use it for daily operations, real estate purchases, and partner buyouts…or anything in between.

Multiple Loan Program Options

Businesses can access the SBA’s most popular loans through Kapitus, including the SBA 7(a) loan which has very few limitations around how small businesses can use the loan, and SBA Express Loans which have an expedited application process where loans can be closed and funded in as little as 14 days.

Capped Interest Rates

Interest rates for SBA 7(a) and Express Loans are negotiated between the borrower and the lender. However, lenders may not go beyond maximum rates set forth by the SBA. The capped rates will vary based on the size of the loan, the industry of the borrower’s business, and the final terms of the loan.

Applying for Your SBA Loan

Minimum Requirements to Qualify for SBA Loans

Qualifying for an SBA loan is based on various factors, depending on the type of loan you are trying to secure along with a fair amount of business-specific information based on your industry. Here are the minimum requirements:

- You must own a US-based, for-profit business.

- You must have less than 500 employees.

- Your business must fall within an SBA-approved industry.

- Your personal credit score must be at least 680.

- You must have established business credit.

- You can not exceed $7.5 Million average revenue each year for the past 3 years.

- You must have fully exhausted all non-SBA financing options.

- You must show invested equity.

Understanding SBA Loan Requirements

SBA loans are a great option for small businesses. They are backed by the federal government through the Small Business Administration which makes them more affordable than other business financing options. However, they are much more difficult to acquire with strict requirements and an abundance of paperwork. Here are the initial factors you must consider before applying for an SBA loan.

Credit Scores

Since the SBA is backing a percentage of your loan, you need to be able to show strong scores for both your personal and business credit. Both the SBA and the SBA-approved lender need to ensure that you are financially responsible in managing both your personal and business expenses, otherwise you could present a significant risk to both.

Invested Equity

Because an SBA loan MAY result in the use of federal funds, the SBA wants to see that a business owner has invested personal time and money into the business, which typically would indicate that everything would be done to keep debt being paid and the business running.

Exhausted Options

With the possibility of government funds being used to cover loan payments, the SBA requires that small business owners exhaust all other avenues of financing before they can acquire an SBA-backed loan. These financing options can include but are not limited to: traditional loans from banks, credit unions, and online lenders; non-bank financing provided by Kapitus; and even loans from friends and family.

If you meet these minimum requirements, you will then need to meet a plethora of additional financing and industry-based requirements that will be based on the size of the loan along with the intended use of the loan.

SBA Loan FAQs

What is the SBA?

The SBA (Small Business Administration) is a U.S. government agency whose primary mission is to support small businesses through various programs, resources, and services.

In addition to providing financing, they also can offer you business counseling, advocacy, and access to government contracts.

What does an SBA Loan cost?

The costs of an SBA Loan will depend on your individual lender’s terms and conditions, plus the SBA Guarantee Fee outlined in your loan agreement terms.

The amount you pay in a guarantee fee is based on the amount of your loan that is guaranteed by the SBA along with your repayment term. This fee is adjusted each fiscal year (October 1 through September 30). The current fee cost runs through September 30, 2024, and can range from 0.00 percent up to 3.75 percent.

Is it hard to get an SBA Loan?

While there are strict eligibility requirements for SBA Loans, many businesses find the lower interest rates and longer repayment terms are well worth it.

Reach out to one of our financing specialists to see if you qualify for an SBA Loan and to explore any further options you may have.

Can a newer, "startup" business get an SBA Loan?

Yes, in some cases. Eligibility requirements may vary depending on your lender, but many newer businesses do receive funding from SBA Loans.

If you aren’t certain of your business’s eligibility, don’t hesitate to reach out to our financing specialists to explore your options.

How long does it take to get an SBA Loan?

The SBA loan application process depends on the loan program and your business, but, generally, Express Loans take, on average, 14 days while between 3–6 months is the average for a 7(a) loan.

Does the SBA offer disaster Loans?

Yes. The SBA does offer disaster loans to help individuals and businesses recover from natural disasters, such as hurricanes, earthquakes, wildfires, floods, tornados, and other catastrophic events.

The two main types of SBA disaster loans for businesses are:

Business Physical Disaster Loans (BPDL) — These loans help businesses repair or replace damaged or destroyed property, with the intention of returning the business to its pre-disaster condition.

Economic Injury Disaster Loans (EIDL) — These loans provide assistance to businesses that have suffered economic impact as the result of a disaster and loss of revenue.

Do I need a down payment for an SBA loan?

Yes. The minimum SBA loan down payment requirement is 10% on 7(a) and 504 loans. Low-value collateral or a business with weak cash flow may require a down payment of up to 30% of the loan amount.

What can SBA loans be used for?

Your SBA 7(a) and Express loan funds can be used for anything you need to operate or expand your business, such as purchasing or updating real estate, working capital, refinancing current business debt, or purchasing equipment and machinery. However, there are limitations places on other types of business loans. For examples, an SBA 504 loan cannot be used for working capital, refinancing current business debt, or purchasing equipment and machinery. However, there are limitations placed on other types of SBA business loans. For example, an SBA 504 loan cannot be used for working capital, purchasing inventory, consolidating or refinancing debt, investment real estate, or financing of Al-related projects, to name a few.